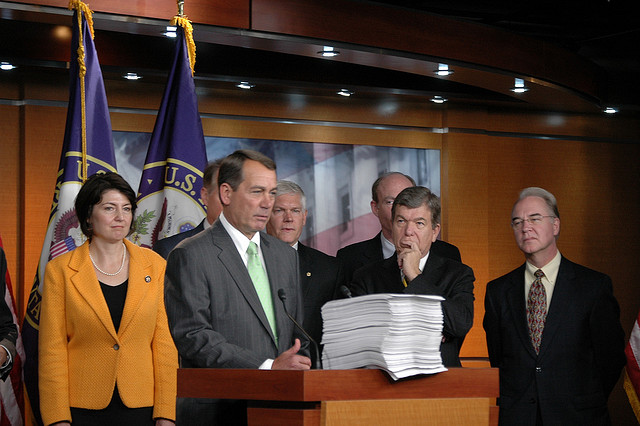

Creative Commons License: GOPLEADER: www.flickr.com/photos/gopleader/

Although old news, there are a fair amount of business owners who are unclear about the most important facts regarding the Affordable Care Act, and how that should impact their Employee Compensation Plan.

The first crucial point that you need to know is that the law is written so that it affects different businesses of different sizes. Consequently, this article will be divided up into those categories, so you can learn the relevant facts about a company in your size.

1. Self Employed.

2. Employing fewer than 25 people.

3. Employing 25-50 people.

4. Employing more than 50 people.

Before we dive in, there are a few quick notes about evaluating how many employees you have. Instead of a strict headcount, you may count “FTEs”. (Full-Time Equivalent employees.) This is useful if you have a mix of part time employees and full timers. Add the average weekly part time hours, and divide by 30, then add that by the amount of full time employees you have. If you’re at 25.01, you fall within the 25-50 employees range.

Is My Business Required To Buy Health Care For My Workers?

In short, unless you have more than 50 employees, no. The Affordable Care Act has made it more attractive for employers to buy health insurance for any level by providing access to cheaper corporate plans, and offering incentives and tax credits. If you do have more than 50 employees, then the penalty for not purchasing health care is $2,000 per employee (max $3,000 per employee if they had paid through SHOP themselves.) That being said, the penalty would only be calculated after the first 30 FTEs.

Self Employed Health Care

Those who are self employed without insurance are mandated to have health insurance. By using “The SHOP Exchanges”, it should be more manageable to find a plan. (SHOP stands for Small business Health Options Programs).

Healthcare Tax Credit

Tax credits are calculated differently (http://www.taxpayeradvocate.irs.gov/calculator/SBHCTC.htm) but your business could qualify for up to a 35% tax credits on a minimum contribution of 50% of employee’s premiums. You would have to file a FORM 8914 to claim the credits.

As always, be sure to consult with an experienced business law attorney before taking any action on matters like these. This blog is for reference/information purposes only and is not legal advice.

© The Law Offices of Thomas Nowland, content contributions by Alexander Miscione.